Transform your

Credit With Expert Financial Guidance

Rebuild, restore, and regain control of your financial future with professional credit repair support backed by real results.

How Can I Help You?

DIY Credit Repair

Step-by-step program that teaches you how to fix your own credit the right way without paying monthly fees, guessing, or using random letters from the internet.

· How to check your credit the RIGHT way

· How to dispute the negative stuff that’s holding you back

· How to build your score correctly

If you’re tired of being denied, tired of paying in cash, tired of feeling stuck

This course is for you. AND if you get stuck you can always upgrade and we will gladly take over. Best of all you get credit for the amount you paid for this course.

Suing Debt Collectors course

Suing Debt Collectors is the system that teaches you how to:

✔️ Respond to Debt collectors

✔️ Spot illegal collection behavior

✔️ Document your evidence the right way

✔️ File and move your case forward

✔️ And get compensated

.

This course gives you the scripts, letters, case examples, and step-by-step process to do it confidently

Collections Help

DEBT COLLECTOR'S EMAILING YOU, CALLING YOU, TEXTING YOU, OR SENDING YOU LETTERS?

We review your case, identify violations, and take action.

Start Your Free Case Review

Just answer a few easy questions on our straightforward questionnaire and send over any additional documents.

Simple as that!

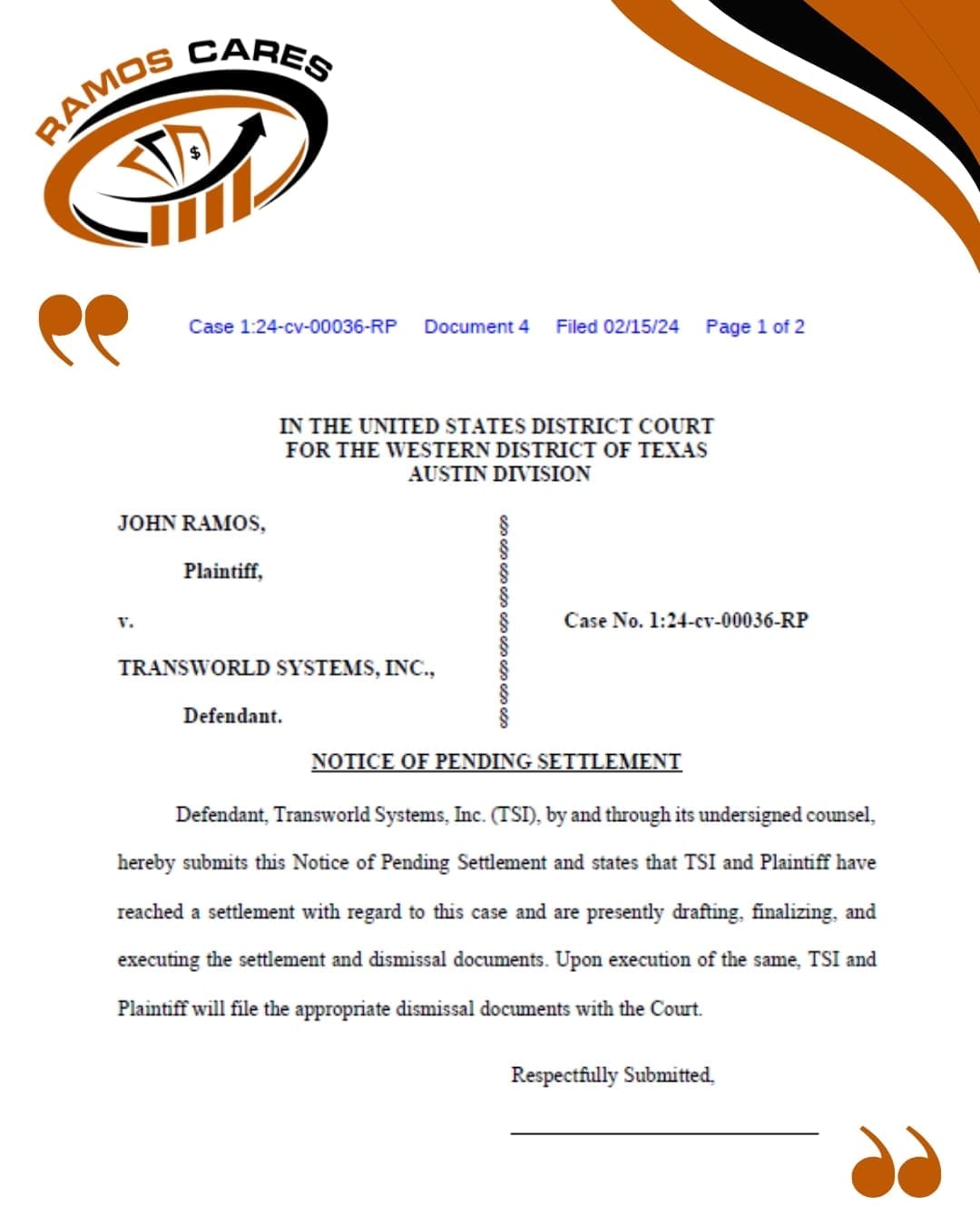

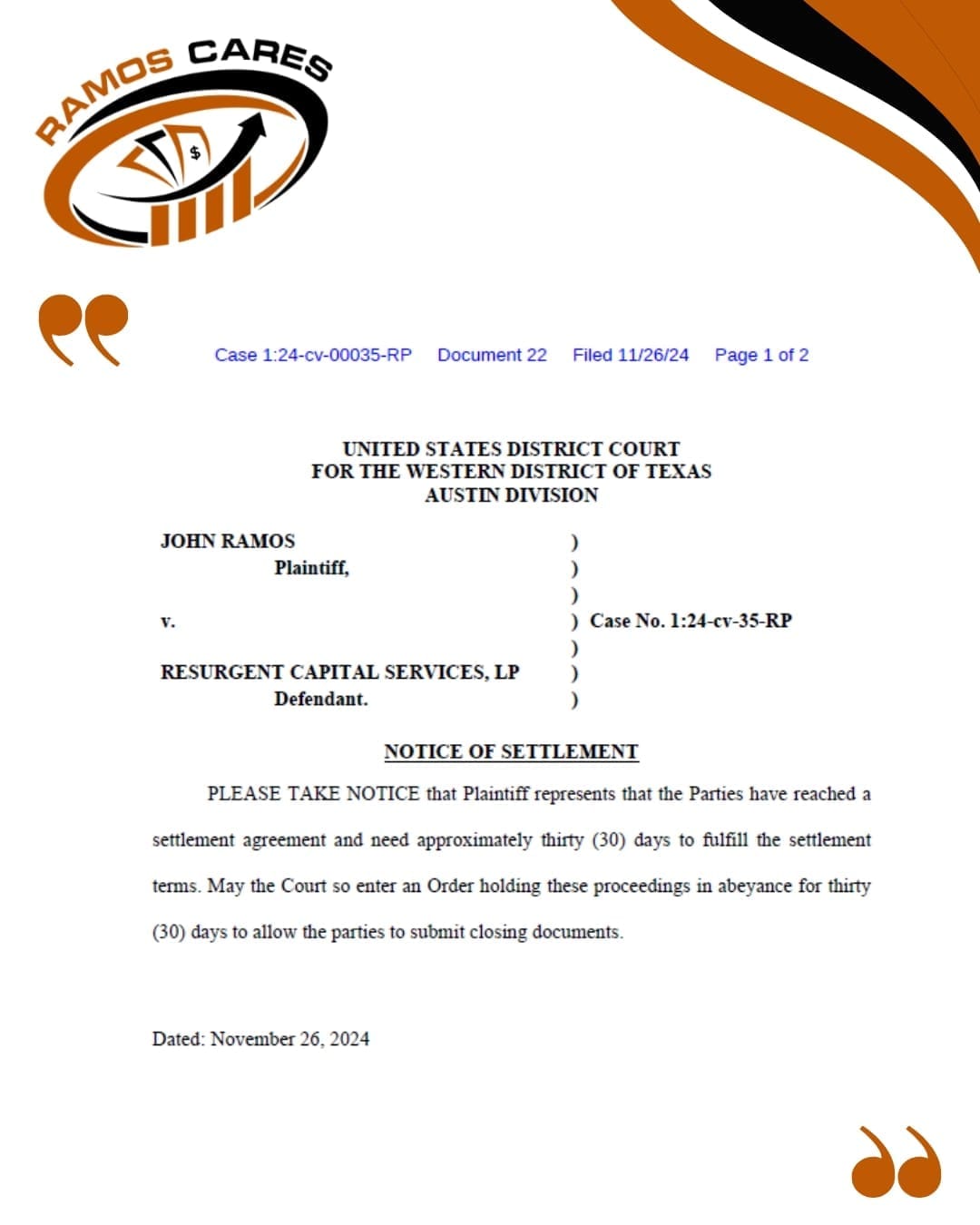

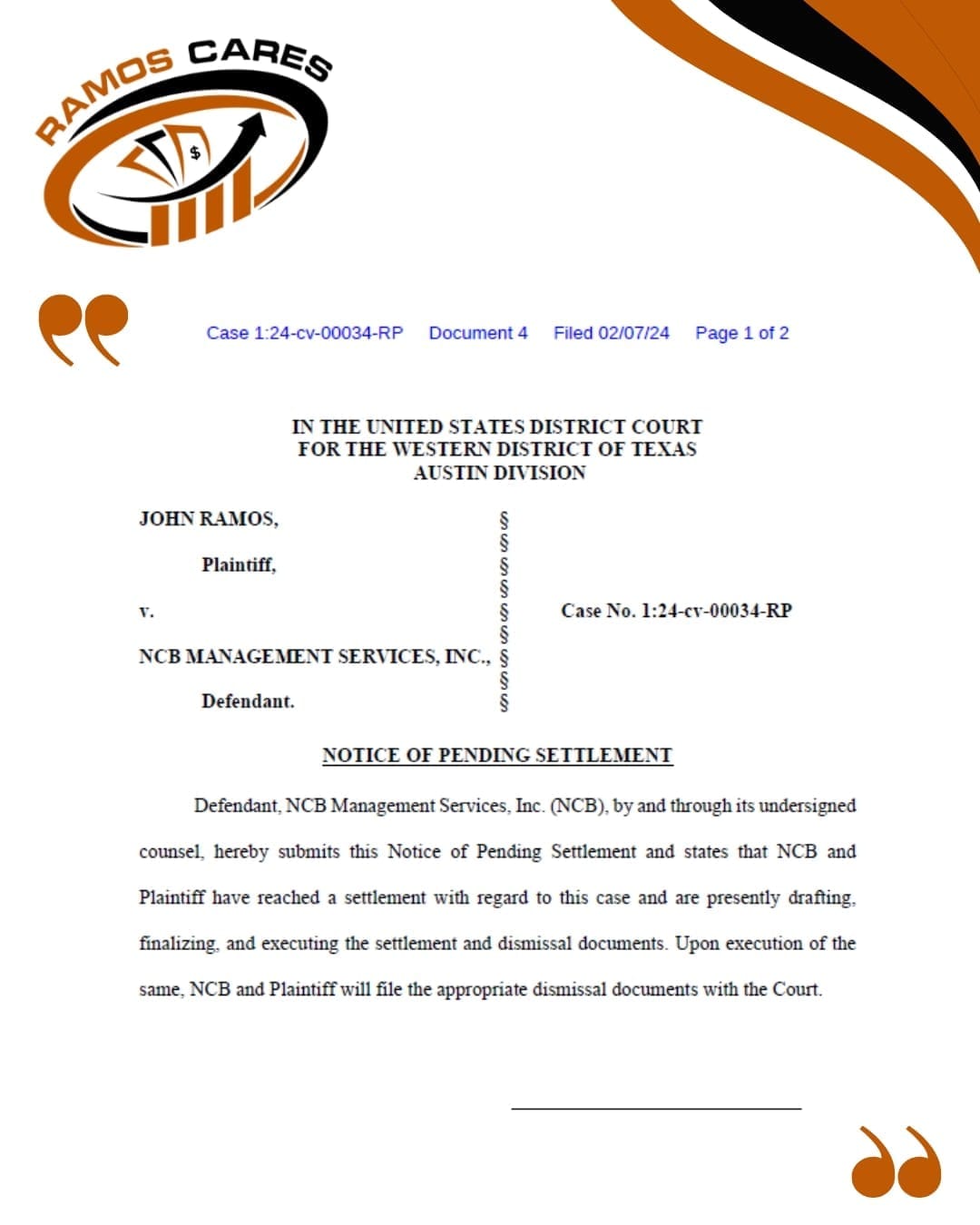

Real Client Experiences

Every client who comes to Ramos Cares brings a different story and a personal credit journey. These are real cases from individuals who trusted John Ramos with their process—showing the genuine work, care, and dedication he puts into serving the people who rely on him.

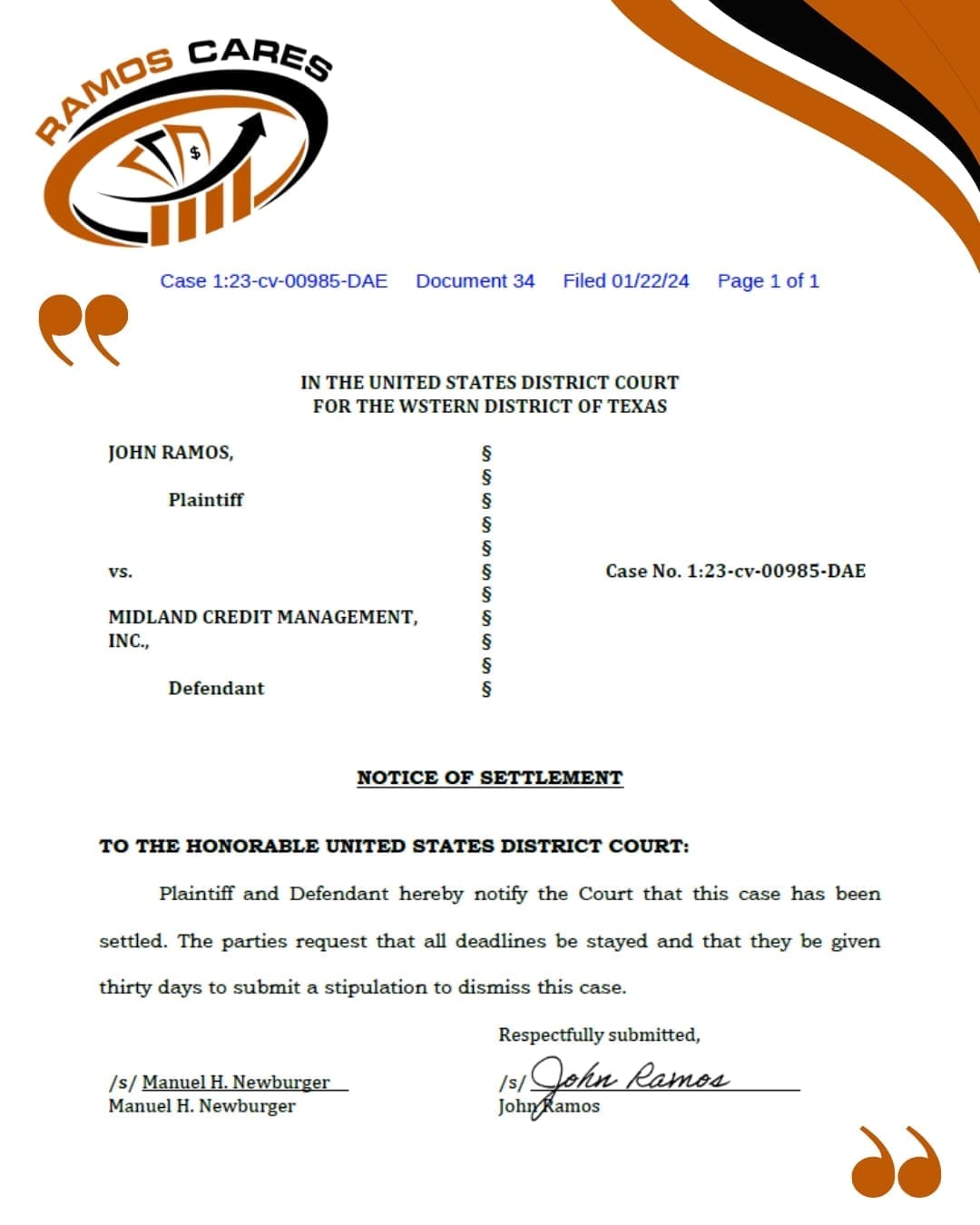

I SUE DEBT COLLECTORS

$997

Your past doesn’t define your financial future.

If you're receiving collection calls, Letters, Text messages, Emails or reporting on your credit reports, this course gives you the strategy and confidence to fight back.

You get the exact steps to regain power, clarity, control and compensated.

DIY CREDIT REPAIR

$149

Rebuild your credit the right way.

Learn how to challenge inaccurate reporting and use proven tools to fix your credit with confidence.

Your transformation starts here, with clarity, control, and a system that actually works.

Collections Help — Know Your Rights and Take Back Control

If you’re being contacted by a debt collector, you may have more power than you think. We help you identify violations, challenge inaccurate reporting, and take the right next steps.

Getting contacted by a collector doesn’t mean you’re stuck.

We review your case for errors, illegal practices, and reporting violations that could lead to deletions — or even compensation.

HERE’S WHAT YOU’LL GET

Complete Review of Your Collection Account

Identification of Any FDCPA or FCRA Violations

A Customized Action Plan Based on Your Case

Guidance on How to Respond to the Collector

Document Review for Accuracy & Compliance

Step-by-Step Instructions to Protect Your Rights

Potential Eligibility for Compensation

Professional, fast, and eye-opening.

Our process is designed to protect you, guide you, and help you regain control of your financial future.

Transform Your Credit Score the Right Way

Fix inaccuracies, remove negative items, and take back control of your financial future using proven credit-repair strategies.

Learn how to dispute errors, rebuild strategically, and increase your approval odds with a system designed for real results.

Schedule Your Case Review Today

Get help with collections, inaccurate reporting, violations, and more — fast, simple, and confidential.

COLLECTIONS ASSISTANCE

Full account review

Check for FDCPA/FCRA violations

Access to attorney to file your case

Only $50.00 per response to debt collector

Flexible booking times available

CREDIT REPAIR

45-minute 1:1 review

Break down your report item by item

Create a clear dispute & action plan

Only $249 enrollment

$150 a month includes credit monitoring

What Our Clients Are Saying

Real Results. Real Protection. Real Credit Wins.

100+

Happy Clients

75+

Cases Done

5+

Years of Experience

Frequesntly Asked Questions

Some Common Questions Always On The top

Yes. If the debt collector violates the FDCPA — such as communicating after being told to stop, reporting inaccurately, and more — you may be able to sue for up to $1,000 per case.

Most consumers don’t realize debt collectors break the law every day.

We check your calls, letters, text, emails, reports, and account history to identify violations quickly.

If you’re being contacted, don’t panic — and don’t admit to anything.

We help you review the case, request proper validation, identify violations, and determine if you may be owed compensation

You only need the collection letter, screenshots, or any messages they’ve sent.

We’ll guide you on anything else needed after reviewing your situation

No. Identifying violations and disputing inaccurate information can help improve your report — not damage it.

Your Credit Comeback Starts Now.

Get the steps, tools, and guidance you need to fix your credit with confidence — starting today.